All Categories

Featured

Table of Contents

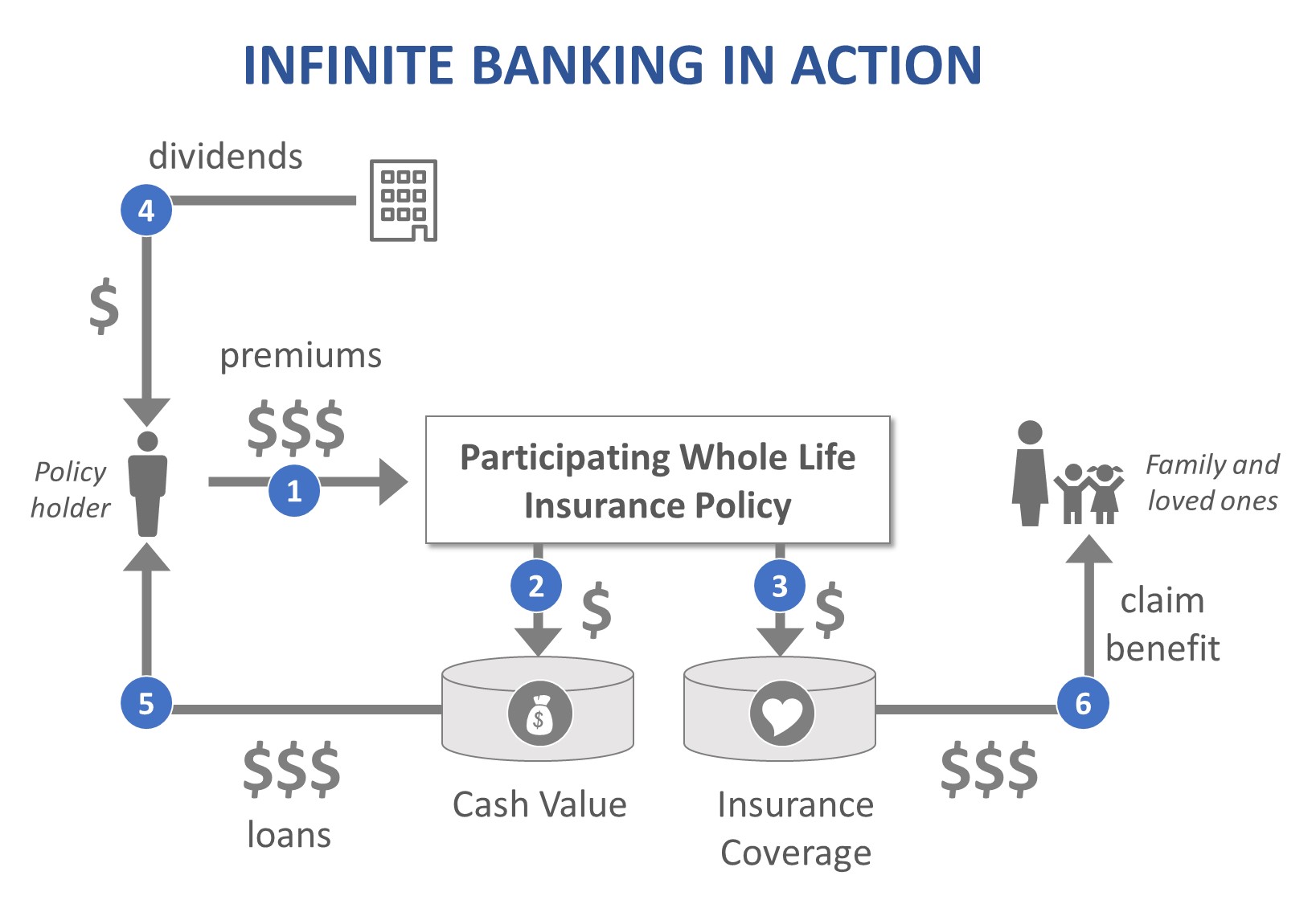

The method has its very own benefits, however it additionally has concerns with high fees, intricacy, and more, leading to it being considered as a scam by some. Boundless financial is not the very best plan if you need only the financial investment element. The unlimited banking principle rotates around the usage of whole life insurance policy policies as a monetary device.

A PUAR allows you to "overfund" your insurance coverage right as much as line of it coming to be a Modified Endowment Contract (MEC). When you make use of a PUAR, you rapidly raise your cash value (and your fatality benefit), thus raising the power of your "financial institution". Further, the more cash money worth you have, the higher your passion and dividend settlements from your insurer will be.

With the increase of TikTok as an information-sharing system, monetary advice and approaches have actually discovered a novel way of dispersing. One such technique that has actually been making the rounds is the infinite banking principle, or IBC for short, gathering endorsements from celebrities like rapper Waka Flocka Flame - Life insurance loans. Nonetheless, while the technique is currently popular, its origins trace back to the 1980s when economic expert Nelson Nash presented it to the world.

Is Privatized Banking System a better option than saving accounts?

Within these plans, the cash value grows based on a rate established by the insurance provider. Once a significant cash worth gathers, insurance policy holders can obtain a cash money worth funding. These car loans vary from traditional ones, with life insurance policy functioning as collateral, implying one could shed their insurance coverage if borrowing excessively without adequate cash money value to sustain the insurance policy expenses.

And while the appeal of these policies appears, there are inherent constraints and dangers, requiring attentive cash value monitoring. The strategy's authenticity isn't black and white. For high-net-worth individuals or business owners, especially those using techniques like company-owned life insurance policy (COLI), the benefits of tax breaks and substance growth could be appealing.

The appeal of infinite banking does not negate its difficulties: Price: The fundamental requirement, an irreversible life insurance policy plan, is more expensive than its term equivalents. Eligibility: Not every person receives whole life insurance due to rigorous underwriting procedures that can omit those with details wellness or way of living conditions. Intricacy and risk: The intricate nature of IBC, coupled with its threats, might hinder many, particularly when simpler and much less high-risk options are offered.

Can I use Whole Life For Infinite Banking to fund large purchases?

Alloting around 10% of your monthly earnings to the plan is simply not possible for lots of people. Using life insurance policy as an investment and liquidity resource calls for discipline and surveillance of plan cash money worth. Get in touch with an economic expert to identify if boundless financial straightens with your concerns. Part of what you check out below is merely a reiteration of what has currently been said above.

Prior to you obtain on your own right into a situation you're not prepared for, know the adhering to first: Although the principle is generally sold as such, you're not in fact taking a funding from on your own. If that were the case, you would not have to repay it. Instead, you're borrowing from the insurer and need to repay it with passion.

Some social media sites messages recommend utilizing cash money worth from whole life insurance policy to pay for credit scores card debt. The idea is that when you repay the financing with interest, the quantity will be returned to your investments. Regrettably, that's not exactly how it works. When you pay back the car loan, a portion of that rate of interest goes to the insurance provider.

Who can help me set up Infinite Banking Vs Traditional Banking?

For the very first numerous years, you'll be repaying the compensation. This makes it exceptionally challenging for your plan to build up worth throughout this time around. Whole life insurance policy costs 5 to 15 times extra than term insurance coverage. Most individuals merely can't afford it. So, unless you can pay for to pay a couple of to several hundred bucks for the following years or even more, IBC will not help you.

Not everyone should count solely on themselves for financial safety. Infinite Banking cash flow. If you require life insurance policy, below are some useful pointers to take into consideration: Take into consideration term life insurance policy. These policies offer coverage throughout years with considerable monetary responsibilities, like mortgages, trainee finances, or when looking after young kids. See to it to shop about for the very best price.

Can Cash Flow Banking protect me in an economic downturn?

Envision never ever having to bother with financial institution finances or high rate of interest rates once more. Suppose you could obtain cash on your terms and develop wealth all at once? That's the power of unlimited banking life insurance policy. By leveraging the cash money worth of entire life insurance IUL policies, you can expand your wide range and obtain money without relying upon conventional banks.

There's no set finance term, and you have the freedom to pick the payment timetable, which can be as leisurely as paying back the finance at the time of death. This adaptability encompasses the servicing of the fundings, where you can go with interest-only settlements, maintaining the funding equilibrium flat and manageable.

What is the best way to integrate Life Insurance Loans into my retirement strategy?

Holding cash in an IUL repaired account being attributed rate of interest can often be far better than holding the cash money on deposit at a bank.: You've always imagined opening your very own bakeshop. You can borrow from your IUL plan to cover the initial costs of renting out an area, purchasing tools, and hiring personnel.

Personal lendings can be gotten from typical financial institutions and credit scores unions. Borrowing cash on a debt card is normally extremely pricey with yearly portion rates of passion (APR) often getting to 20% to 30% or more a year.

Latest Posts

A Beginner's Guide To Starting Your Own Bank

Want To Build Tax-free Wealth And Become Your Own ...

Infinite Banking Reviews